Mortgage Lenders now require copies of Tax Calculations (SA302s) and Tax Year Overview for self employed applicants. These documents can be downloaded from HMRC Gateway online tax return submission service.

However, we find that our clients frequently have trouble navigating the HMRC website and obtaining copies of the required documents in the required format. This guide is designed to make it simple to obtain what you need from HMRC Gateway where you as the taxpayer are accessing HMRC Gateway via your own log-ins.

If you sent your return using commercial software or by paper you can’t print a copy of the tax calculation from this account but you can print the tax year overview.

If you used commercial software to send your return, you must use that software to print your tax calculation. Lenders can request up to 3 years figures so it is best to print out SA302’s and Tax Year Overviews covering the last 3 completed returns.

Lenders like data to cover a period finishing no longer than 15 months from the mortgage application date. Therefore an application late in the calendar year may well need returns provided covering the tax year ending in the year of application.

Logging in

Can be a problem before you start, go to:

https://www.access.service.gov.uk/login/signin/creds

You log into HMRC Gateway with user ID and password

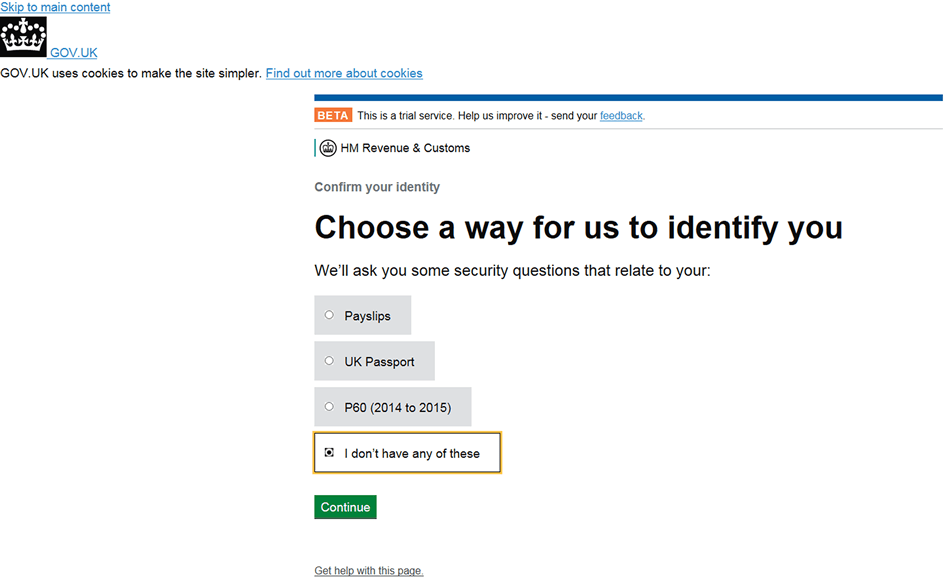

Select: I don’t have any of these

Click: Continue

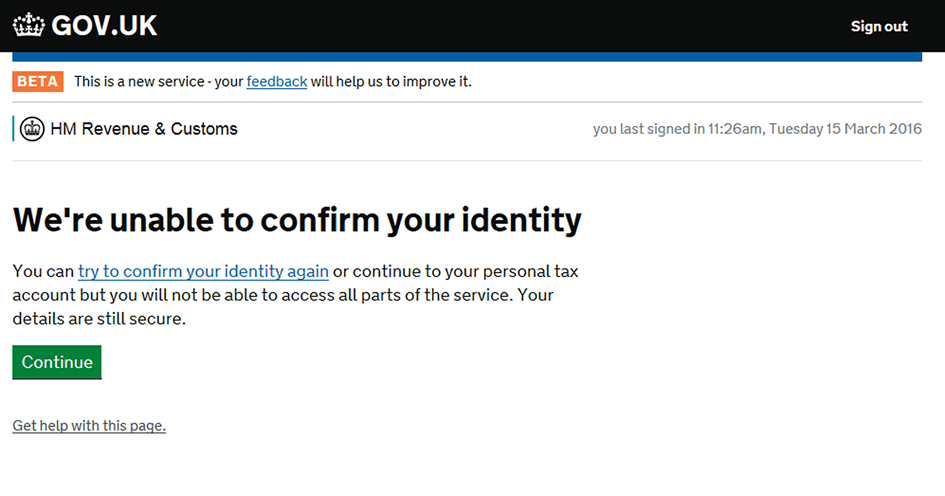

This gets you to the ‘We’re unable to confirm your identify’ page

Select: I don’t have any of these

Click: Continue

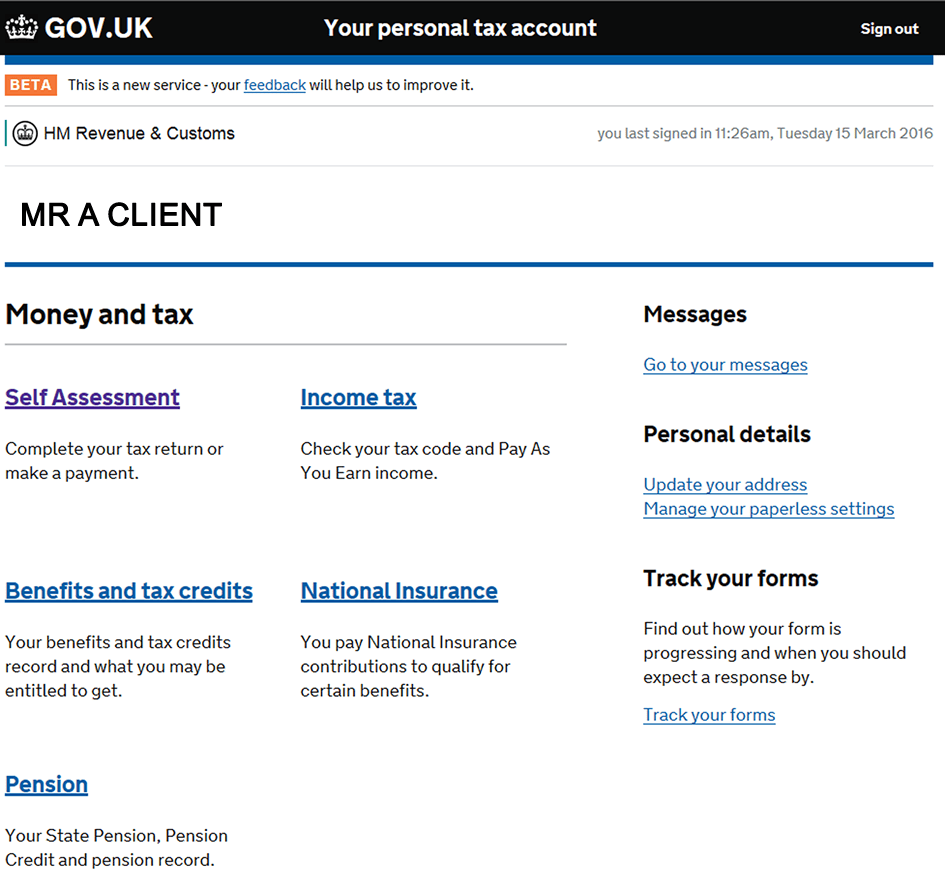

This gets you to the ‘Your personal tax account’ page

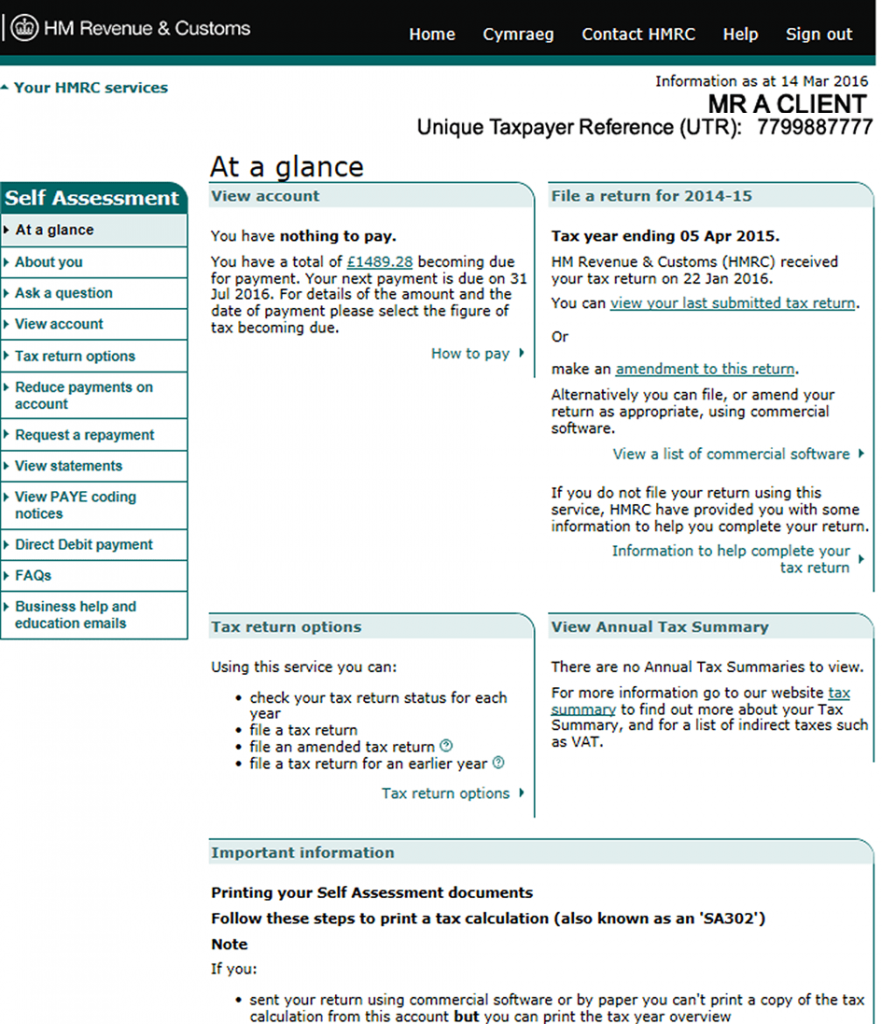

Click: Self Assessment

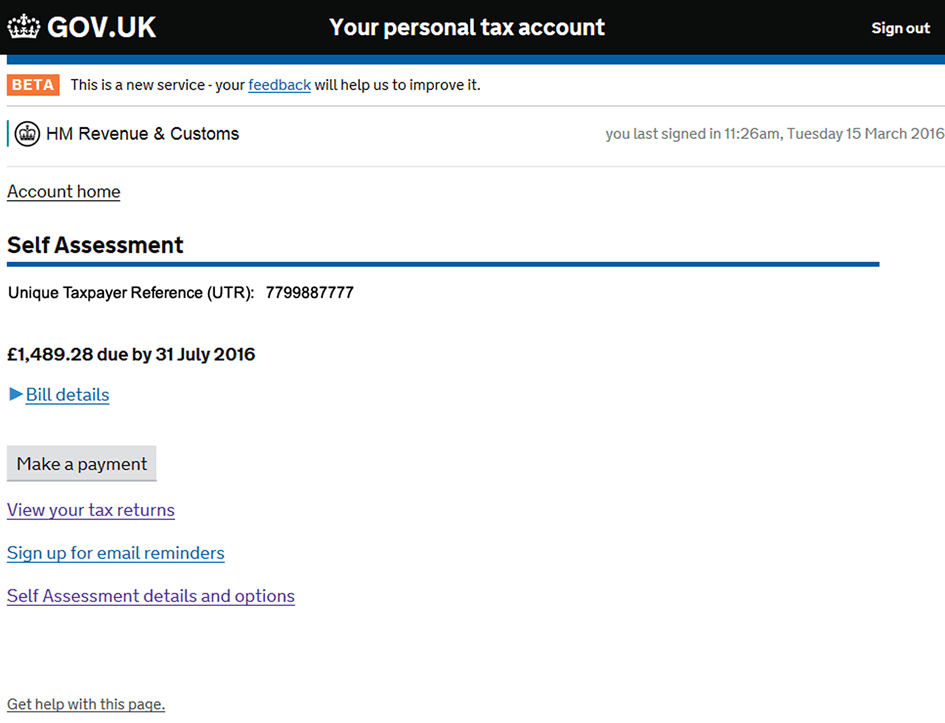

This gets you to the ‘Your personal tax account | Self Assessment’ page

Click: View your tax returns

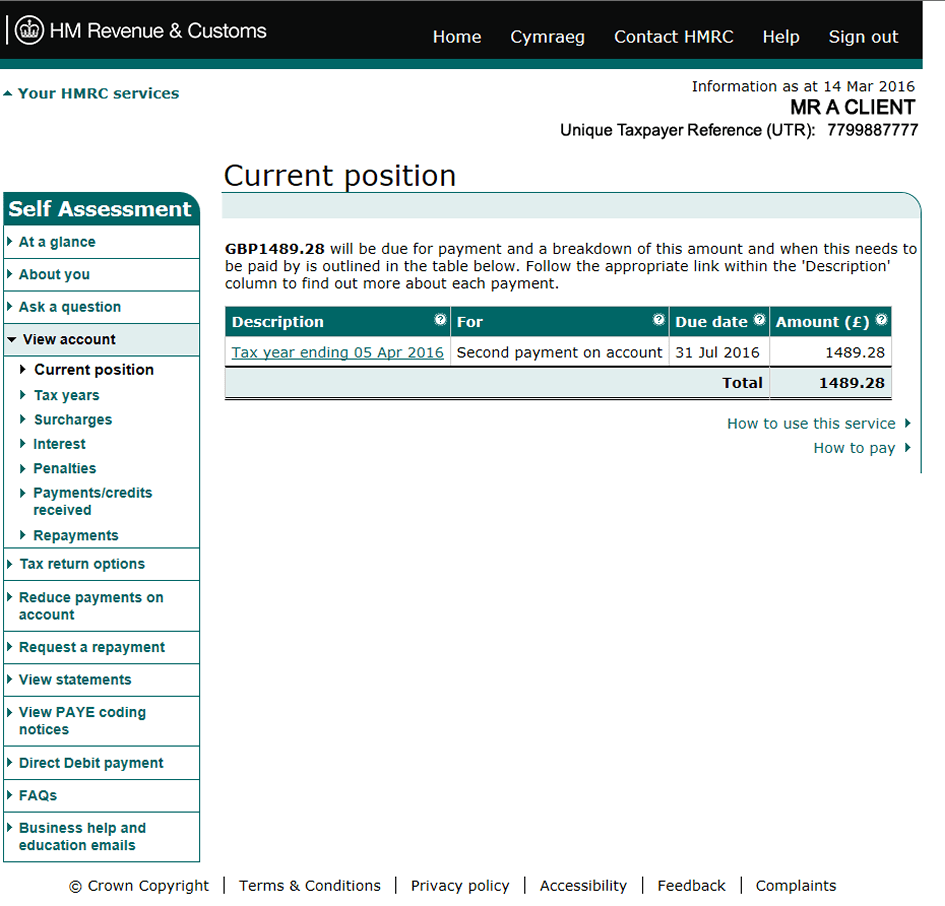

Accessing and printing your documents

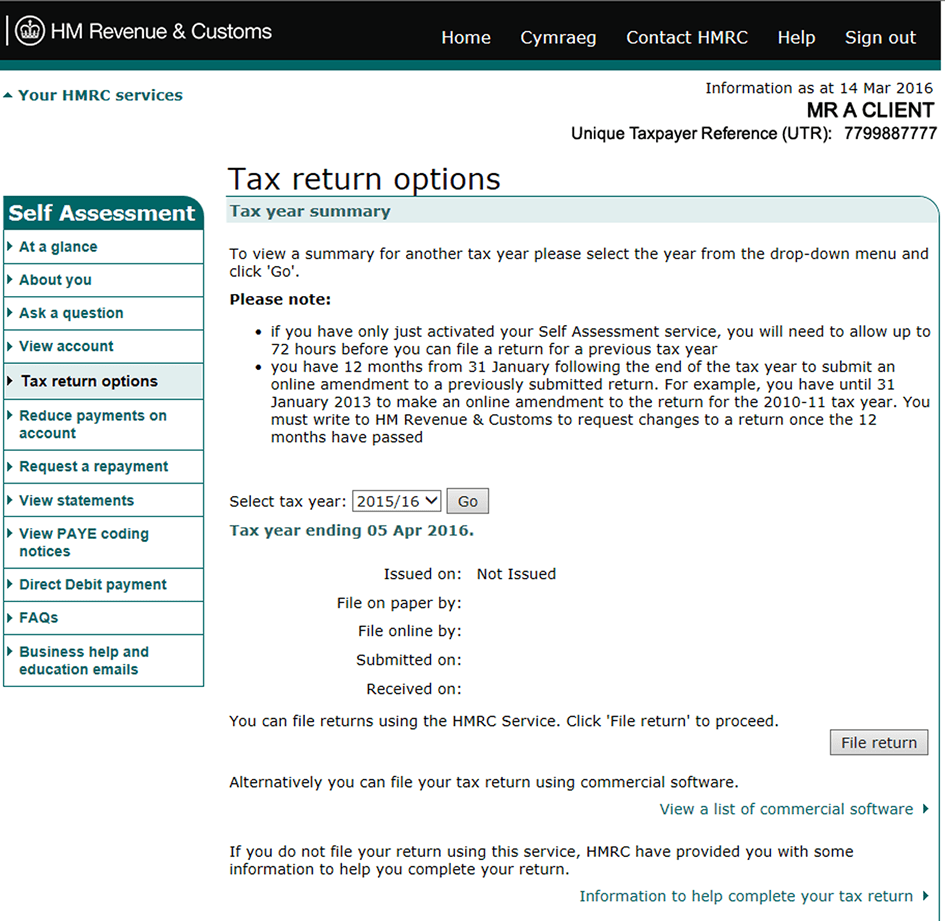

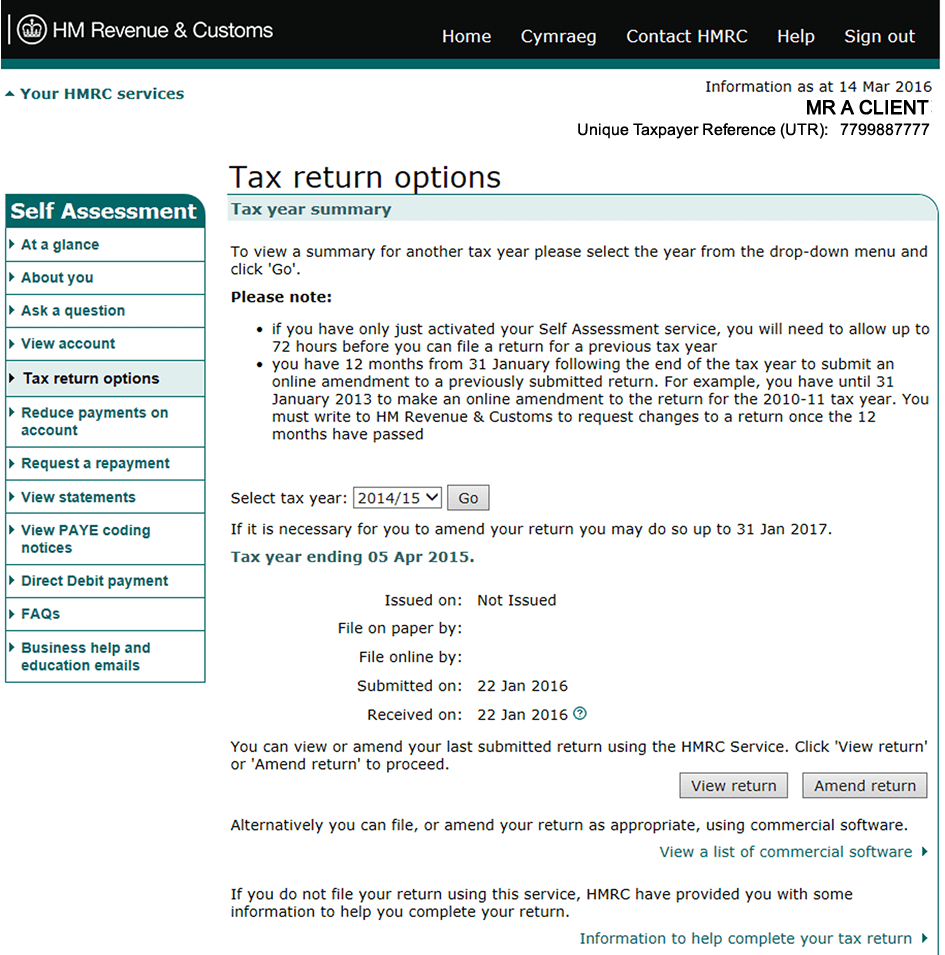

Select tax year

Click Go

The system drops in details of your return for that tax year

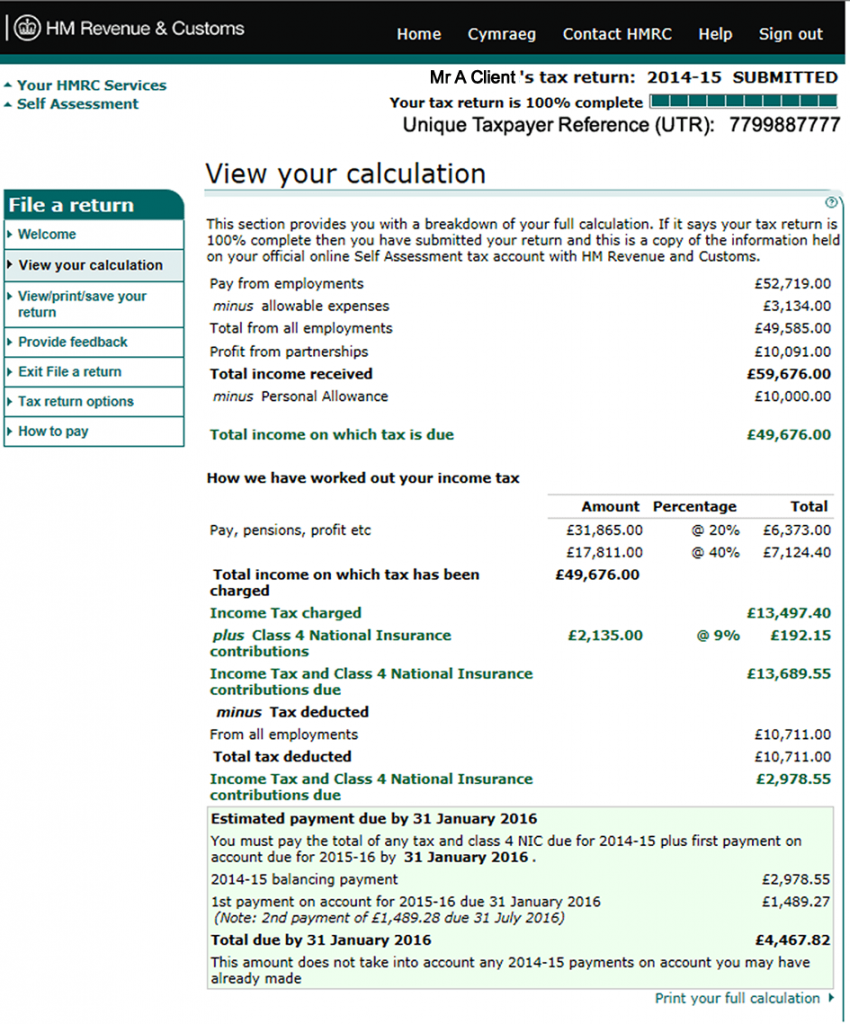

Click: view return (right hand side), this brings up figures for the return

Click: print your full calculation bottom right

(or use save option in left hand menu)

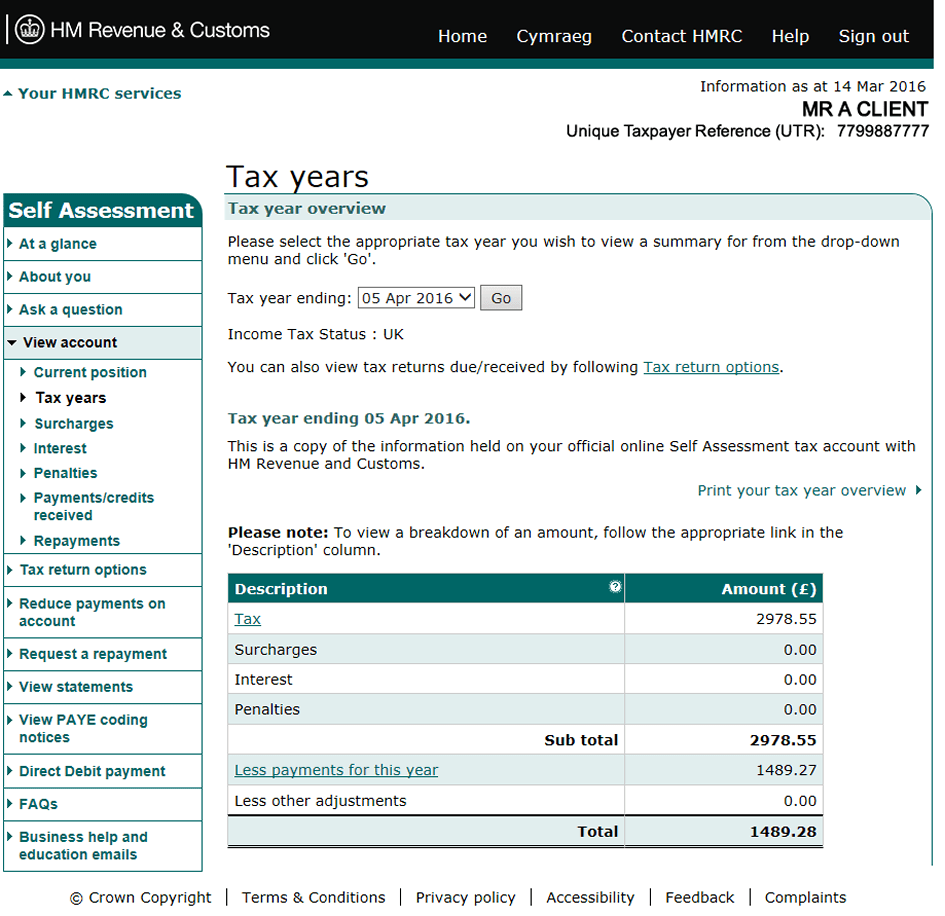

How to print out your tax Year Overviews

Go back to self assessment menu using self assessment link top left

Click: View Account – left hand menu

Click: Tax Years

Choose year from the list

Click: Print your Tax Year Overview

Need help with your self-employed mortgage or re-mortgage?

We can help.

A Mortgage Now are independent, whole of market, mortgage brokers. We provide

mortgage advice across the whole of the UK and work exclusively over the internet and

telephone which means:

- No meetings

- No paperwork

- No fuss

We specialise in mortgage applications for the self-employed.