Barclays Mortgage Rates for Existing Customers – 60% loan to value

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 1 Year Fixed | 4.69% | 31/03/2025 | £0 | 60% |

| 2 Years Fixed | 4.51% | 31/03/2026 | £999 | 60% |

| 2 Years Fixed | 4.69% | 31/03/2026 | £0 | 60% |

| 5 Years Fixed | 4.46% | 31/03/2029 | £999 | 60% |

| 5 Years Fixed | 4.65% | 31/03/2029 | £0 | 60% |

| 10 Years Fixed | 5.15% | 31/03/2024 | £999 | 60% |

| 10 Years Fixed | 5.22% | 31/03/2024 | £0 | 60% |

Barclays Mortgage Rates for Existing Customers – 75% loan to value

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 1 Year Fixed | 4.90% | 31/03/2025 | £0 | 75% |

| 2 Years Fixed | 4.70% | 31/03/2026 | £999 | 75% |

| 2 Years Fixed | 4.90% | 31/03/2026 | £0 | 75% |

| 5 Years Fixed | 4.54% | 31/03/2029 | £999 | 75% |

| 5 Years Fixed | 4.75% | 31/03/2029 | £0 | 75% |

| 10 Years Fixed | 5.15% | 31/03/2024 | £999 | 75% |

| 10 Years Fixed | 5.22% | 31/03/2024 | £0 | 75% |

Barclays Mortgage Rates for Existing Customers – 85% loan to value

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 1 Year Fixed | 5.87% | 31/03/2025 | £0 | 85% |

| 2 Years Fixed | 5.55% | 31/03/2026 | £999 | 85% |

| 2 Years Fixed | 5.73% | 31/03/2026 | £0 | 85% |

| 5 Years Fixed | 4.54% | 31/03/2029 | £999 | 85% |

| 5 Years Fixed | 4.75% | 31/03/2029 | £0 | 85% |

Barclays Mortgage rates

- Existing Barclays borrower?

- Looking for a new Barclays Mortgage Deal – secure new rate up to 180 days ahead?

- Make one simple phone call to 020 8979 9684 with your Barclays Mortgage Account Number

- No need to book an appointment with a Mortgage Adviser

- No need to register for Online Banking

- Prefer to work online? click here

Barclays Mortgage Tracker Rates for Existing Customers

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 2 Year Tracker | 5.39% | 31/03/2026 | £999 | 60% |

| 2 Year Tracker | 5.74% | 31/03/2026 | £0 | 60% |

| 5 Year Tracker | 5.85% | 31/03/2029 | £999 | 60% |

| 2 Year Tracker | 5.61% | 31/03/2026 | £999 | 75% |

| 2 Year Tracker | 5.75% | 31/03/2026 | £0 | 75% |

| 2 Year Offset Tracker | 6.47% | 31/03/2026 | £1,749 | 80% |

| 2 Year Offset Tracker | 6.50% | 31/03/2029 | £1,749 | 80% |

Barclays Buy to Let Mortgage Rates for Existing Customers – 65% loan to value

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 2 Year Fixed | 5.30% | 31/03/2026 | £1,795 | 65% |

| 2 Year Fixed | 5.65% | 31/03/2026 | £0 | 65% |

| 5 Year fixed | 4.59% | 31/03/2029 | £1,795 | 65% |

| 5 Year Fixed | 4.83% | 31/03/2029 | £0 | 65% |

| 2 Year Tracker | 6.59% | 31/03/2026 | £1,795 | 65% |

| 2 Year Tracker | 7.20% | 31/03/2026 | £0 | 65% |

Barclays Buy to Let Mortgage Rates for Existing Customers – 75% loan to value

Rates for existing customers current as of January 31, 2024| Type | Rate | Until | Fee | LTV |

| 2 Year Fixed | 5.35% | 31/03/2026 | £1,795 | 75% |

| 2 Year Fixed | 5.69% | 31/03/2026 | £0 | 75% |

| 5 Year fixed | 4.60% | 31/03/2029 | £1,795 | 75% |

| 5 Year Fixed | 4.88% | 31/03/2029 | £0 | 75% |

| 2 Year Tracker | 6.67% | 31/03/2026 | £1,795 | 75% |

| 2 Year Tracker | 7.20% | 31/03/2026 | £0 | 75% |

| 2 Year Tracker | 7.89% | 31/03/2026 | £299 | 75% |

Barclays mortgage rates for existing customers – good news

- You can reserve your new Barclays mortgage rate, for free, with us – now

Existing customers can reserve a new Barclays mortgage rate up to 180 days before your current deal ends. - You can switch to your new rate swiftly

We can get your new mortgage rate offer secured same day we receive your instruction. - We check your eligibility for you with Barclays

We check your mortgage balance and current valuation and let you know all the Barclays mortgage rates available to you. - There are no credit checks involved

You can get a new mortgage rate regardless of your recent credit history. - If your circumstances have changed – don’t worry

We can arrange a new Barclays mortgage rate for existing customers even if your income has dropped. - There’s no need for valuer to visit

We obtain a valuation from the Lender, at no cost. - There’s no need for a solicitor

You won’t need a solicitor to change your Barclays Mortgage Rate.

Barclays Woolwich Eligibility

In order to be eligible for these products:

- You must be an existing Barclays Woolwich residential mortgage client

- Your mortgage account must be up to date with no history of arrears

- You must be currently on a product with a product end date in the next 90 days

- Or you should already be on the Barclays Woolwich standard variable mortgage rate

Process for Barclays mortgage rate switch

You can use the link above to request help online, or call our team on 020 8979 9684. Have to hand your Barclays mortgage account number (this is 10 digits long and starts with ‘9’).

We will confirm the estimated value of your property so that loan to value can be assessed.

From that point it is possible to identify the range of tracker and fixed mortgage rates available to you from the Barclays Woolwich range.

Once you, as the borrower decide on your preferred rate, we request the new mortgage rate on your behalf from Barclays Woolwich, which is then put in place as the current rate ends. This means you avoid mortgage interest on the relatively expensive 3.59% variable rate (3.49% above BOE Base Rate).

Barclays require no underwriting for existing mortgage customers

Barclays mortgage rate switches are arranged without any proof of income or further financial information requested by the lender. This means:

- No credit scoring

- No wage slips for employed borrowers

- No accounts or SA302s for self employed borrowers

- No bank statements

- No affordability checks

Further advances, term changes, home moves, and removal of a borrower, all require underwriting in the usual way.

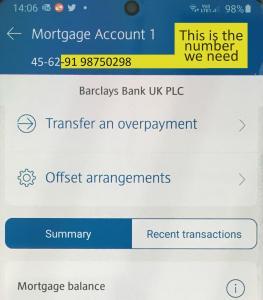

How to find your Barclays Mortgage Account Number

Your Barclays Mortgage Account Number will be 10 digits long starting with a ‘9’ (residential mortgages, buy to let mortgages use a difference number).

This can sometimes be difficult to find buy you can find in on your latest mortgage statement, or on your Barclays App

Finding your Barclays Mortgage Account Number on your Barclays App

Log on to your Barclays App and Navigate to your Barclays Mortgage Account.

Your Barclays Mortgage Account Number number is at the top of the screen (see below). Ignore the first four digits and note the other 10

Finding your Barclays Mortgage Account Number on your Barclays Mortgage Statement

Refer to page one of your Barclays Mortgage Statement (see below).

Under ‘Summary of your account with us‘ look for description ‘Mortgage Account’ – your mortgage account number is to the left separated by two hyphens

Rate switches and Barclays Mortgage Reserve Accounts

If you have made use of your Barclays reserve account facility the interest on this funding is charged separately from your main mortgage. Therefore you cannot switch rate on this proportion of your mortgage lending.

The balance on your mortgage reserve is added to your main mortgage balance when calculating loan to value on your mortgage borrowing.

Removal of the Barclay’s mortgage reserve facility

You may have recently had correspondence from Barclays letting you know that they intend to remove or reduce your mortgage reserve facility.

They are doing this because having mortgage reserve account available to their borrowers makes it difficult for them to predict and control their overall lending pattern within the current rules of the Regulator.

If you use any mortgage reserve facility before Barclays reduce your limit, or remove your facility, you should be able to repay it under your normal terms. We have not heard of Barclays calling in any facility that has been already used.

Always consider use of your Barclays mortgage reserve facility carefully as we see a number of borrowers who have used the account to maintain their lifestyle during difficult times and have been unable to pay back the capital leaving them with a long-term problem.

Mortgage Product Transfer with another Lender? – click below

- Accord Mortgages Product Transfers

- Aldermore Mortgages Loyalty Rates

- BM Solutions Product Transfer rates

- Coventry Building Society new mortgage deals

- Godiva Mortgages Product Transfers

- Halifax Product Transfers

- HSBC Mortgage Customer Switching Rates

- Kensington Mortgages Product Transfers

- Kent Reliance Mortgage Product Transfer rates

- Leeds Building Society Product Transfer rates

- Metro Bank Switch Deals Existing Customers

- NatWest Mortgage switch deals

- Nationwide existing customers rate switch

- Paragon Bank Mortgage Product Switch Service

- Platform Mortgage Rates Existing Customers

- Precise Product Transfers

- Santander Product Transfer rates

- Scottish Widows Bank Mortgage Product Transfer rates

- Skipton Mortgage Customer Switching Products

- The Mortgage Works | mortgage product switches for existing TMW buy to let borrowers

- Virgin Money Mortgage Deals Existing Customers